Indian Markets Open Steady As Fed Meet, Trade Uncertainty Keep Bulls In Check; Tata Motors Drops, L&T Soars

Analysts see the Nifty trading between 24,680 and 24,920. FII selling and MSCI index rebalancing are expected to add volatility in the coming days.

Indian equity markets opened on a cautious note, with the Nifty index hovering above 24,800.

Market mood will hinge on the US Federal Reserve’s policy stance and commentary due later today and the lingering uncertainty around the India-US trade deal ahead of the August 1 deadline. US President Donald Trump has warned that India could face a tariff higher than the rate agreed upon for some of its Asian peers.

At 09:40 a.m. IST, the Nifty 50 traded 40 points higher at 24,861, while the Sensex was up 122 points at 81,460. Broader markets were mixed, with the Nifty Midcap index declining 0.1% and the Smallcap index rising 0.1%.

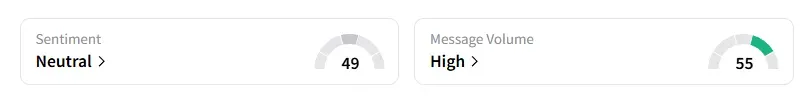

Meanwhile, the retail sentiment on Stocktwits for Nifty has moved to ‘neutral’ amid ‘high’ message volumes.

Stock Watch

Sectorally, auto, real estate, and energy saw some selling pressure, while media, metals, and pharmaceuticals gained.

Tata Motors was the top Nifty loser with its shares falling over 3% on reports that the automaker may acquire Italy-based Iveco Group’s truck business for $4.5 billion.

L&T shares rose 4% becoming the top Nifty gainer, following a strong show in the June quarter and a strong orderbook for FY26. Jefferies maintained a ‘Buy’ rating and raised the target price to ₹4,230, indicating 21% upside.

Other earnings movers include GE Vernova (+5%), Allied Blenders and Dilip Buildcon (+4%), Piramal Enterprises (+2%).

JSW Steel was among the top Nifty gainers after the Supreme Court agreed to hear its review plea in the Bhushan Power case. This allows them one final legal opportunity to retain control of BPSL, a company it took over in March 2021 through the corporate insolvency resolution process.

Watch out for Tata Steel, Power Grid, PNB, Hyundai Motor India, InterGlobe Aviation, IIFL Finance, JB Chemicals, KPIT Technologies, Zydus Wellness, among others, as they report quarterly earnings today.

And the ₹4,011 crore Initial Public Offering (IPO) of National Securities Depository Limited (NSDL) opens for subscription today. The issue has been priced between ₹760 and ₹800 per share.

Markets: The Road Ahead

From a technical standpoint, SEBI-registered analysts on Stocktwits shared the trade setup.

Ashish Kyal said the Nifty index can consolidate in a broad range today. If prices move towards 24,750-24,770 and form a reversal candle, it could provide an opportunity to buy for a move to 24,890-24,920 levels. On the downside, 24,680 is seen as the immediate support. Kyal noted that markets are likely to remain rangebound between 24,680 and 24,920 on Wednesday.

Prabhat Mittal identified Nifty intraday support at 24,680 and resistance at 25,020. For the Bank Nifty, he sees support at 55,900 and resistance at 56,600.

Varunkumar Patel highlighted that Foreign Institutional Investors sold over ₹4,600 crore worth of stocks in the cash market. In the F&O segment, they added fresh net index short positions. This suggests that yesterday’s market upmove was likely a result of oversold technical conditions, with the PCR also indicating short-term bullish exhaustion. He added that the attention now shifts to the upcoming MSCI Emerging Markets Index rebalancing announcement on August 7, which could significantly impact flows.

Patel advised sticking to selective opportunities and ensuring tight stop-losses. Volatility could rise in the coming sessions due to global cues and index rebalancing factors.

Global Cues

Globally, Asian markets traded mixed as the US and China reportedly look to extend their 90-day trade truce. Geopolitical concerns resurfaced after US President Trump expressed dissatisfaction with Putin over stalled peace talks in Ukraine and issued a 12-day deadline, triggering a sharp upmove in both crude oil and gold.

The most relevant Indian markets intel delivered to you everyday.

For updates and corrections, email newsroom[at]stocktwits[dot]com.